how to claim new mexico solar tax credit

New Solar Market Development Income Tax Credit Electronic Submission. Eligible systems include grid-tied commercial PV systems off-grid and grid-tied residential PV systems and active solar hot water or hot air systems.

New Mexico Solar Incentives Rebates And Tax Credits

This incentive is proposed to last until January 2029.

. Here are the benefits you can get from New Mexicos clean energy program. The first is your application packet filled out electronically. Other New Mexico solar incentives will bring your savings well beyond the thousands you get in federal and state government tax credits and include property tax exemptions and renewable energy credits.

These programs are usually time sensitive. Upload the first of two PDF documents. Line 14 For this line youll need to switch to the worksheet at the top of page 4 in the 5695 instructions.

The credit is applicable for up to 8 years starting in 2020. New Mexico solar rebates. New Mexico Taxation and Revenue Department NEW SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Schedule A Apply unused credit from carry-forwards before applying new credit to the net New Mexico income tax amount due.

To be eligible systems must first be certified by the New Mexico Energy Minerals and Natural Resources Department. The wait is over. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

Top Benefits of Using Air Conditioning System. An applicant shall apply for the state tax credit with the taxation and revenue department and provide the certification and any other information the tax and revenue department requires within 12 months following the calendar year in which the system was installed. However the amount of your claim should not exceed 6000.

Check 2022 Top Rated Solar Incentives in New Mexico. Understanding How New Mexico Solar Tax Credits Work. There are three main steps youll need to take in order to benefit from the ITC.

Enter the beginning and ending date of the tax year of this claim. Fill Out the Binder of Required PDFs. Claiming the New Mexico Solar Tax Credit Step One.

10 Income Tax Credit. Determine if youre eligible. The solar market development tax credit may be deducted only from the taxpayers New Mexico personal or fiduciary income tax liability.

The credit is capped at 6000. This is the amount of renewable energy production tax credit. The Renewable Energy Production Tax Credit REPTC NMSA 1978 7-2A-19 has sunset but created a significant incentive for economic development in New Mexico attracting utility-scale renewable energy developers to the state and assisting utilities in meeting state Renewable Portfolio Standard RPS requirements.

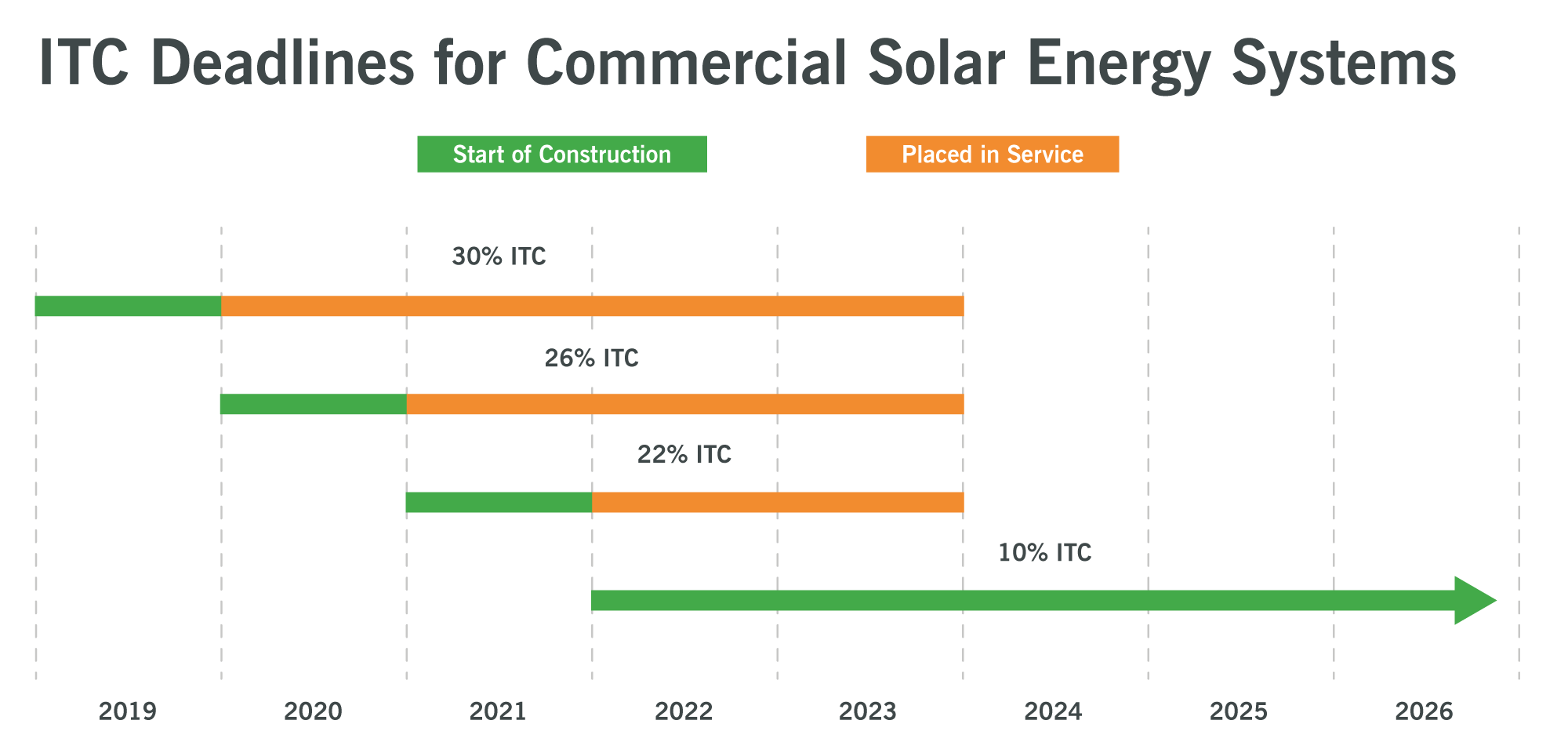

The residential ITC drops to 22 in 2023 and ends in 2024. For the purposes of this article lets assume the gross cost of your solar system is 25000. See form PIT-RC Rebate and Credit Schedule.

This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower. See below for forms. Any solar installations in your home or business will allow you to claim new mexico solar tax credits of as much as 10.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. The tax credit applies to residential commercial and agricultural installations. Redesign Your Backyard This Fall.

Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. Worksheet Line 1 Enter the total taxes you owe you found this out earlier and entered it into line 47 on your 1040 form. CLAIMING THE STATE TAX CREDIT.

For information on Form TRD-41406 with the email address and phone number to the New Mexico Taxation and Revenue Department please go to the New Solar Market Development Tax Credit Claim Form. While New Mexico does not have a dedicated state rebate for solar panel installation some manufacturers like LG offer their own solar rebates. New Mexicos popular solar tax credit scheme that previously aided about 7000 residents is brought into action again.

Complete IRS Form 5695. Social security number SSN Name of taxpayer Mailing address Name of contact City state and ZIP code E-mail address Phone number 1. Add to Schedule 3 and Form 1040.

The balance of any refundable credits after paying all taxes due is refunded to you. The federal solar tax credit. Find out if you have any limitations to your tax credit.

Check Rebates Incentives. For wind and biomass projects it offers a one cent per. For example LG offers a 600 solar rebate on their equipment which your installer can help you redeem over the next year.

This is the PDF document originally. Note that solar pool or hot tub heaters are not eligible for this tax credit. The tax credit is up to 10 of the purchase and installation of the solar panels.

Enter Your Zip See If You Qualify. New Mexicos solar tax credit will revive the states solar industry. Fill Out the Application The New Mexico Energy Minerals and Natural Resources Department EMNRD oversees.

12790 Approximate system cost in NM after the 26 ITC in 2021. Why Should You Go Solar. For assistance completing this form or claiming the credit call 505 827-0792.

Obviously there are many incentives to go solar such as the benefits provided by the New Mexico solar tax credit but truly solar can be viewed as an. The new solar tax credit has the potential to do more than just save. Enter the percentage of the renewable energy production tax credit that may be claimed by the claimant.

The percentage must match the percentage for the claimant as shown on the Notice of Allocation issued by EMNRD for the year of this claim. After it expired in 2016 New Mexicos governor Michelle Lujan Grisham signed the New Solar Market Development Tax. 7 Average-sized 5-kilowatt kW system cost in New Mexico.

Credit that is unused e in a tax year may be carried forward for a maximum of 5 consecutive tax years following the tax year in. SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the fiduciary income tax return Form FID-1. Low-Cost Kitchen Upgrades that Make a Big Impact.

New Mexico state solar tax credit. You can sign into the Taxpayer Access Point TAP - Submit a Document and follow the prompts to attach this form to your return. Multiply line 5 by line 6.

The 3 steps to claiming the solar tax credit. Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax creditin other words you may claim the credit in 2021. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits.

Ad Enter Your Zip Code - Get Qualified Instantly.

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Instalacion Placas Solares Puerto Rico Mechannika Solar Energy Residential Solar Solar Solar Screens

Federal Solar Tax Credit Guide Atlantic Key Energy

/GettyImages-471189055-68b876e5b18f4b16b8dd71a0304e820d.jpg)

Are Free Solar Panels Really Free

Customer Solar Program Pnmprod Pnm Com

Solar Panel Incentives Rebates Tax Credits A Definitive Guide

Did David Avocado Wolfe Post A Meme About Solar Panels Draining Light From The Sun Solar Solar Panels Solar Pv

Federal Solar Tax Credit 2022 How It Works How Much It Saves

Stamp Duty Stamp Duty Good Credit Save Yourself

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Exemptions Sales Tax And Property Tax 2022

How The Solar Tax Credit Makes Renewable Energy Affordable

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

A Solar Tax Credit Rate Expires In 2021 Here S How To Get It Before Then

Securitization The Next Big Thing In Solar Energy Financing Council On Foreign Relations

.png)

Federal Solar Incentives New Mexico Solar Company

Solar Tax Credit Details H R Block

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Credit Vs Trec Which Incentive Is Best In New Jersey Green Power Energy